Startup failure analysis

The concept of Startup dates back to the year 1550, but definitely with another name. And according to the startup historian, the ‘Edison General Electric Company, now known as ‘GE’, may be framed as the first Startup on this planet.

Eventually, the startup boom didn’t exist before the end of the 1990s, which is also known as the DOT COM boom era. Most of the Unicorns, namely, Facebook, Linkedin, Twitter, Amazon, Google, Uber, Airbnb, Tesla, Yahoo, and Dropbox, started after 1998 or early 2000.

From that time to 2022, in this years the startup ecosystem has seen a meteoric rise mainly in the number of startups. But, despite this rise, most startups today are facing tough times, and most of them are closing their doors within their initial stages.

How Did We Build this Report?

We communicated with over 472 founders of failed or closed startups across the globe and asked about their harrowing experiences and what were the painful Peebles in their shoes behind their failed ventures.

Here’s what we have learned and accumulated from them:

How and Why Did Their Startup Fail?

All of the startups were in different stages of their growth whose founders are the input points of this detailed report. We asked them fundamental questions like:

- When had they foreseen that their startups were going to fail?

- What was the one cardinal reason or factor behind their failure?

- The actual lesions they have learned from it.

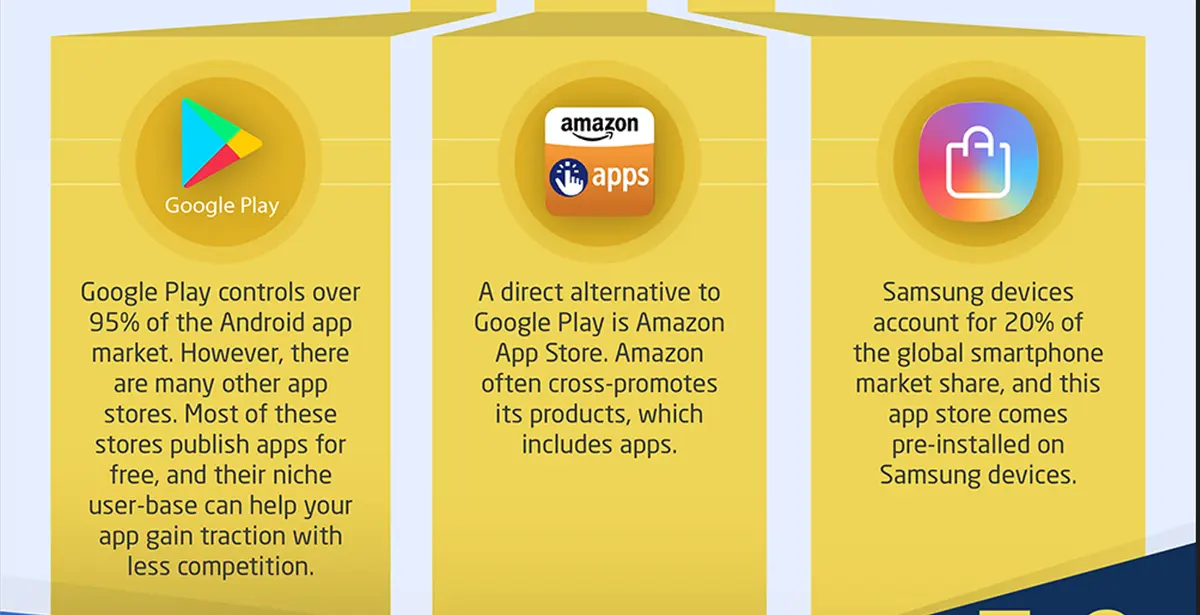

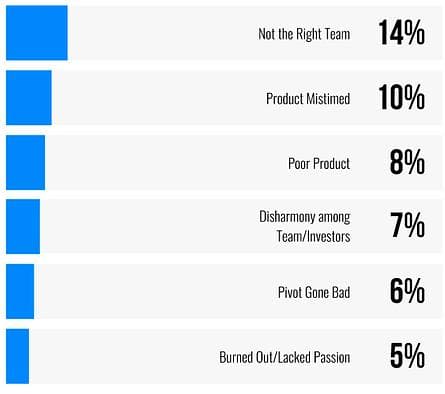

There are other reasons too that are not that illustrious like these above, but they also played cardinal roles like:

- Lacking passion - Ex. - DaWanda (https://www.cbinsights.com/company/dawanda)

- Team & Inverter’s non-integrity - Hubba (https://www.cbinsights.com/company/hubba)

- Product Validation Issues - ScaleFactor (https://www.cbinsights.com/company/scalefactor)

- Mistimed Launch - Vreal (https://www.cbinsights.com/company/vreal)

Shape, Size and Other Parameters of These Startups as We Found Out

The diversity of these Startups under scanner was overwhelming. According to many Startup pundits, aside the funding reasons, the reason behind failure for any startup can come from inherent entrepreneurial reasons or other factors such as the core values of the working force, their adaptation abilities, and the distributed strength of the team functioning as a conglomerate towards a common purpose.

We delve deep into the stipulated information we harnessed from these founders and use that data to measure most of the corporate, human resource and geo-location-related parameters related to these failed startups.

Industry-Specific Segregation of These Startups

We Analyzed accumulated data and grouped these failed startups regarding their business verticals to understand the diversified challenges that originated from different business sectors. And here’s what we found out:

Global Industry Distribution of Startups

Startup businesses operate in a wide variety of industries, but are most populous in technological fields

Fintech, Health and AI have been the continuous leaders since 2018, and as the startup ecosystem goes ahead in the coming years, technology will surely lead the direction of the same.

Funding- Specific Segregation of these Startups

A significant chunk of these failed startups had gone through multiple funding layers, commonly known as ‘series’. We tried to understand if there is any dominant funding type or series among these startups except VC farms. We couldn’t find any leading funding type or any specificity among them.

We focused on the five traditional funding types for these startups:

- Series Funding - From A to E(VC funds, Angle Investors)

- Crowd Funding - Funding from Friends, Family members, Communities, and Customers

- Loan - From Bank & other Financial Organizations, Small Business Administration

- Venture Capital

- Angle Investor

Here’s what we observed:

As was predicted, more than half of the startups were funded by VC firms, followed by Angel investors & Micro-VC firms. Still, in 2022 the funding trends for startups remain unchanged, although there is a steep fall in VC firm funding volume in 2022, around a 23% fall from last year.

The Timeline of Startup Failures in the Last 5 Years

We have covered a list of major startups that failed during this report data collection period. The funding trends and other financial factors have deeply impacted both the steady and sudden fall of all startups. Similarly, as we have found out, the funding stream for many of these failed startups was not gapless, and this single factor governed the success-to-failure ratio of the startup world.

About Bluethrone’s Startup failure analysis report

Going with the startup market standards, only 1% of the startups become unicorns globally. And 90% of all the startups failed. Of all startups, 10% close their doors within the first year.

Knowing these elemental startup failure stats, Bluethrone delved into the segment of the startups that have failed and tried to churn out more information from these failed ventures. All respondents shared their information through regular digital communication channels like email, e-meetings, 1:1 interview sessions, and social channels.

Check out our most-read articles

Keep reading

.webp)